Businesses save 27% on average with Payment Evolution

Setup Fees

Cancellation Fees

User Fees

Deposit Fees

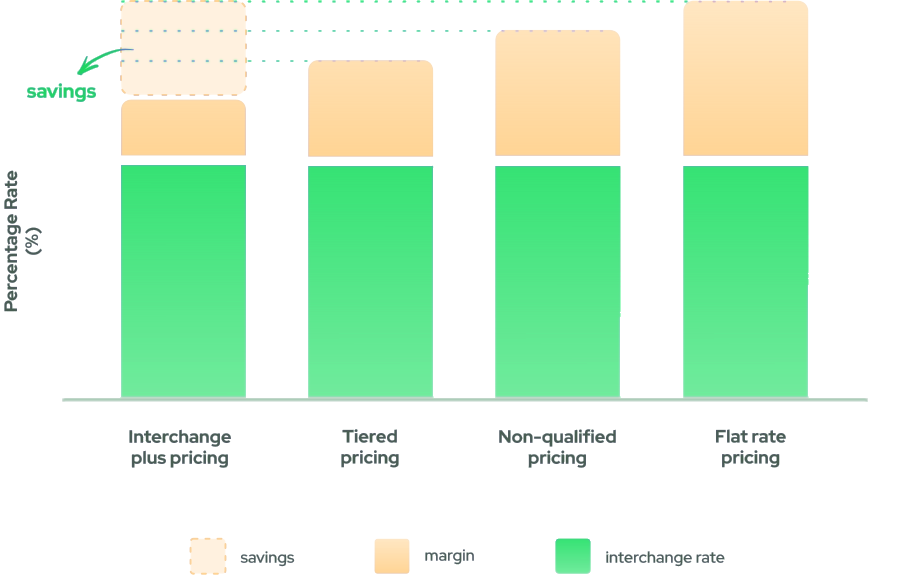

Interchange Plus Pricing

No need to haggle over rates. You save money because we aggressively optimize the interchange rates of every transaction by giving you access to the lowest possible interchange fee for every credit card type.

The interchange fee – or interchange rate – is the true cost for processing a given transaction and is paid to the customer’s bank (not us).

This fee is determined mostly by the type of card used and how it is processed. Since every credit card processor is on the hook for the same interchange fee for a given transaction, keep an eye on their margin to understand how much they are taking for themselves.

FAQ

Interchange Plus pricing takes the wholesale cost of the transaction, adds a set margin on top, and passes on the savings directly to our merchants.

Alternative models like the flat rate pricing adopt a one-size-fits-all approach, charging a flat rate regardless of transaction's actual cost. This method often results in a higher margin for the provider, effectively diminishing your profits.

Interchange fees are determined by the card brand networks — these are updated every April and October.

- The pricing model and your processor’s margin

- The interchange rate

- The card brand and transaction type

- Your business industry

We have a wide selection of terminals available for rent or outright purchase. As you get set up, we can help you select the best terminal for your needs or any other customizations you might need.

An effective rate is the best way to compare the savings from one processor to another. Overall, the best way to tell what you are being charged is to take all your fees and divide that by how much you processed in credit card sales. This is known as your effective rate.

PCI is a mandatory certificate required annually by credit card brands to keep merchants accountable for protection of cardholder data.

One solution for all your payment acceptance needs

Protection by CardSecure

Omnichannel solutions

Seamless POS integrations

Automate Recurring Billing

Detailed Reporting