Affordable Payments built for your business

Payment Evolution is the easy and affordable solution for small and medium businesses accepting credit card payments in-person or online.

Setup Fees

Cancellation Fees

User Fees

Deposit Fees

Businesses save 27% on average with Payment Evolution

We help your business get paid in person, on the go, or online.

Build a fully-hosted online store or add payments to your current website.

Keyed & over the phone

Get paid faster with Online Invoicing and the Virtual Terminal.

Why People Love Us

24/7 Team Support

From our simple onboarding to 24/7 every day support, reach us with our dedicated success and support teams by phone or online

Plug-and-Play Setup

Quick and easy installation of payment hardware and software without the need for extensive technical expertise

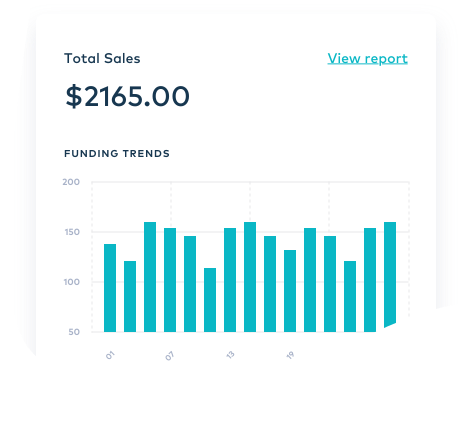

Transaction Management

Monitor transactions in real-time, manage their account settings, view reports, and issue refunds. Get a clear overview of a business’s payment activity, making it easier to track sales and identify trends.

Unbeatable Pricing

With our transparent pricing, clinics save 27% on average when switching to Payment Evolution.

Next-Day Funding

Improve cash flow and operational efficiency with next day funding.

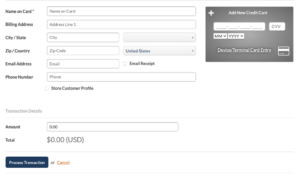

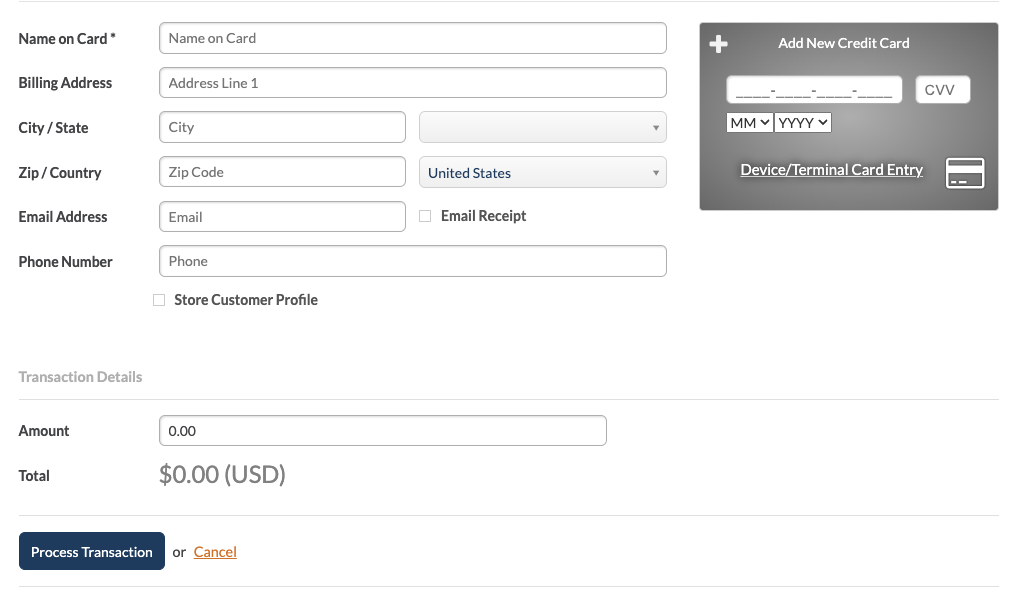

Virtual Terminal

Our Virtual Terminal allows you to take payments over the phone hassle-free

FAQ

Lowest industry rates, vet-friendly tools, easy setup, and excellent customer support!

No. All agreements are month to month agreements. If, for any reason, you decide that the service is not for you just cancel at any time without penalty.

Interchange plus (or “cost plus”) pricing is a straightforward way to price. If you have cost plus pricing, it is more transparent because it is much more difficult to have hidden fees. In cost plus pricing, processors take all the bank fees, card brand fees etc, pass them straight through to the merchant, then add a markup (i.e 20%) for their fees. So, if you were being charged 20% using interchange pricing, you would say, I am being charged “cost plus 20”, which in general is a pretty good deal.

Payment Evolution primarily uses cost plus pricing. Overall, the best way to tell what you are being charged is to take all your fees and divide that by how much you processed in credit card sales. This is known as your effective rate.

CardPointe is a payment processing platform developed by CardConnect. With every active merchant account you receive free access to the Cardpointe processing and reporting dashboard which includes:

- Research and reconcile transactions/settlements

- Print and export detailed transaction and settlement reports

- Store customer profiles and automate recurring billing plans

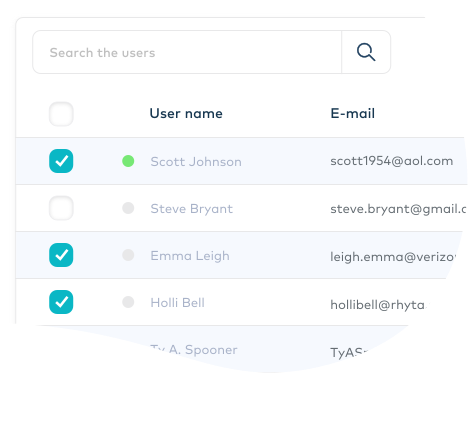

- Set up and activate multiple users within a single account

and so much more… - CardPointe allows you to process transactions on a retail terminal, the mobile app (smart phone and iPad compatible) and the online virtual terminal and view transactions in real time across any CardPointe reporting tool.

Typically, we can get accounts approved in 24-48 hours.

Yes!

The CardPointe mobile app will allow you to process transactions from any mobile device (iOS and Android compatible) as well as from iPad devices.

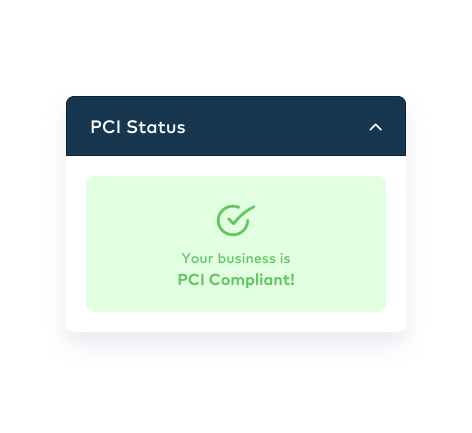

PCI is a mandatory certificate required annually by credit card brands to keep merchants accountable for protection of cardholder data.

An effective rate is the best way to compare the savings from one processor to another. Overall, the best way to tell what you are being charged is to take all your fees and divide that by how much you processed in credit card sales. This is known as your effective rate.

The processing fee you pay to accept payments could depend on several factors such as:

- The pricing model and your processor’s margin

- The interchange rate

- The card brand and transaction type

- Your business industry

Real-time Reporting

Track credit card transaction data analytics in real-time and perform actions like voids and refunds

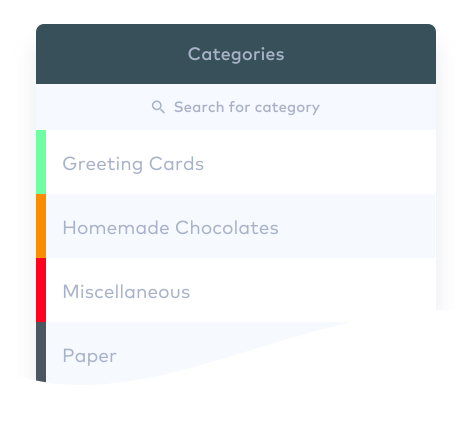

Product Catalog

Organize, label, price and even discount your products and services for an easy checkout process

Recurring Billing

Set up custom bill plans for your customers with recurring payments

PCI Compliance Management

Check the status of your compliance at any time.

Customer Profiles

Save customer information to make checkout even quicker for return visits and future transactions

Virtual Terminal

Input credit card transactions manually from anywhere